- English

- French

Nouvelles

QC Copper Announces Publication of its Updated Mineral Resource Estimate and Technical Report

Toronto, ON – February 23, 2024 – QC Copper and Gold Inc. ("QC Copper" or the "Company") (TSXV: QCCU) is pleased to announce the publication of its updated Technical Report for the pit-constrained Mineral Resource Estimate (MRE) on the Opemiska Deposit which the Company announced on January 8, 2024. The Technical Report is available on the Company’s website and SEDAR+.

Highlights include:

- Mineral Resource in Measured and Indicated category of 2.09 billion lbs of copper equivalent contained in 97.5 million tonnes or

- 1.75 billion lbs of copper,

- 845 thousand ounces of gold,

- 5.5 million ounces of silver

- Additional Inferred Mineral Resource of 157 million lbs of copper equivalent contained in 11.0 million tonnes,

- 127 million lbs of copper,

- 70 thousand ounces of gold

- 907 thousand ounces of silver

- Grade and Mineral Resource Increase: Achieved a remarkable 26% increase in the Copper total grade, an 11% increase in CuEq total grade, and a 16% rise in CuEq pounds compared to the 2021 Measured and Indicated Mineral Resource Estimate.

- Significant Starter Pit: A sizable potential starter pit comprises 19.1 million tonnes at 1.1% Cu-Eq, all in the Measured and Indicated Mineral Resources categories.

- Favorable Metallurgy: Preliminary test work has confirmed very favorable metallurgical characteristics.

- Expansion Potential: Confirmed potential for Opemiska's expansion within the pit, at depth with an out-of-pit (underground) mining scenario, and growth of the satellite pits to the east, as well as in close proximity to the Cooke and Robitaille Mines.

This updated MRE reflects a significant increase in grade and contained metal, attributed to extensive drilling and our technical team's two-year recompilation and reinterpretation of geological data. The Company also underscores that the qualitative improvements in the database enhance our confidence in the project’s geological model and, by extension, the Mineral Resource Estimate.

Table 1: Opemiska Deposit Summary of Pit Constrained Mineral Resources, 0.15% CuEq cut-off and Out-of-Pit Mineral Resources, 0.8% CuEq cut-off (see footnotes 1-10)

|

Pit Constrained |

Tonnes |

Cu |

Cu |

Ag |

Ag |

Au |

Au |

CuEq |

CuEq |

|

0.15% CuEq Cut-Off |

(k) |

(%) |

(M lbs) |

(g/t) |

(koz) |

(g/t) |

(koz) |

(%) |

(M lbs) |

|

Measured |

52,704 |

0.77 |

892 |

1.65 |

2,800 |

0.30 |

500 |

0.94 |

1,091 |

|

Indicated |

34,629 |

0.77 |

586 |

1.31 |

1,458 |

0.24 |

261 |

0.90 |

690 |

|

M+I |

87,333 |

0.77 |

1,478 |

1.52 |

4,258 |

0.27 |

762 |

0.93 |

1,780 |

|

Inferred |

9,791 |

0.48 |

104 |

2.19 |

689 |

0.18 |

55 |

0.59 |

128 |

|

|

|

|

|

|

|

|

|

|

|

|

Out of Pit |

Tonnes |

Cu |

Cu |

Ag |

Ag |

Au |

Au |

CuEq |

CuEq |

|

0.8% CuEq Cut-Off |

(k) |

(%) |

(M lbs) |

(g/t) |

(koz) |

(g/t) |

(koz) |

(%) |

(M lbs) |

|

Measured |

4,064 |

1.24 |

111 |

3.81 |

498 |

0.32 |

42 |

1.44 |

129 |

|

Indicated |

6,067 |

1.18 |

157 |

3.92 |

764 |

0.22 |

42 |

1.32 |

176 |

|

M+I |

10,130 |

1.20 |

268 |

3.87 |

1,261 |

0.26 |

83 |

1.37 |

305 |

|

Inferred |

1,162 |

0.89 |

23 |

5.84 |

218 |

0.40 |

15 |

1.15 |

29 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

Tonnes |

Cu |

Cu |

Ag |

Ag |

Au |

Au |

CuEq |

CuEq |

|

0.15% & 0.8% CuEq Cut-Off |

(k) |

(%) |

(M lbs) |

(g/t) |

(koz) |

(g/t) |

(koz) |

(%) |

(M lbs) |

|

Measured |

56,767 |

0.80 |

1,003 |

1.81 |

3,297 |

0.30 |

542 |

0.97 |

1,219 |

|

Indicated |

40,696 |

0.83 |

743 |

1.70 |

2,222 |

0.23 |

303 |

0.97 |

866 |

|

M+I |

97,463 |

0.81 |

1,746 |

1.76 |

5,519 |

0.27 |

845 |

0.97 |

2,085 |

|

Inferred |

10,953 |

0.53 |

127 |

2.58 |

907 |

0.20 |

70 |

0.65 |

157 |

1. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

2.The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio- political, marketing, or other relevant issues.

3.The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could potentially be upgraded to an Indicated Mineral Resource with continued exploration.

4.The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

5. Metal prices used were US4.00/lb Cu and US$1,875/oz Au, US$24/oz Ag and 0.76 CDN$/US$ FX. Cu, Au and Ag process recovery and smelter payable were 91%, 72% and 72% respectfully. Open pit mining cost was C$2.50/t, processing C$14/t, G&A C$2.25t. Out of pit mining costs were C$68/t.

6. Pit slopes were 50 degrees in rock and 30 degrees in overburden.

7. Historical mined volumes were depleted from the blocks to report the correct tonnages and metal content of the remaining high-grade vein material.

8. CuEq % = Cu % + (Au g/t x 0.54) + (Ag g/t x0.007.

9.Out-of-pit Mineral Resources were selected which exhibit continuity and reasonable potential for extraction by the long hole underground mining method. Narrow strings of grade blocks and orphaned blocks were depleted.

10. Totals may not sum due to rounding.

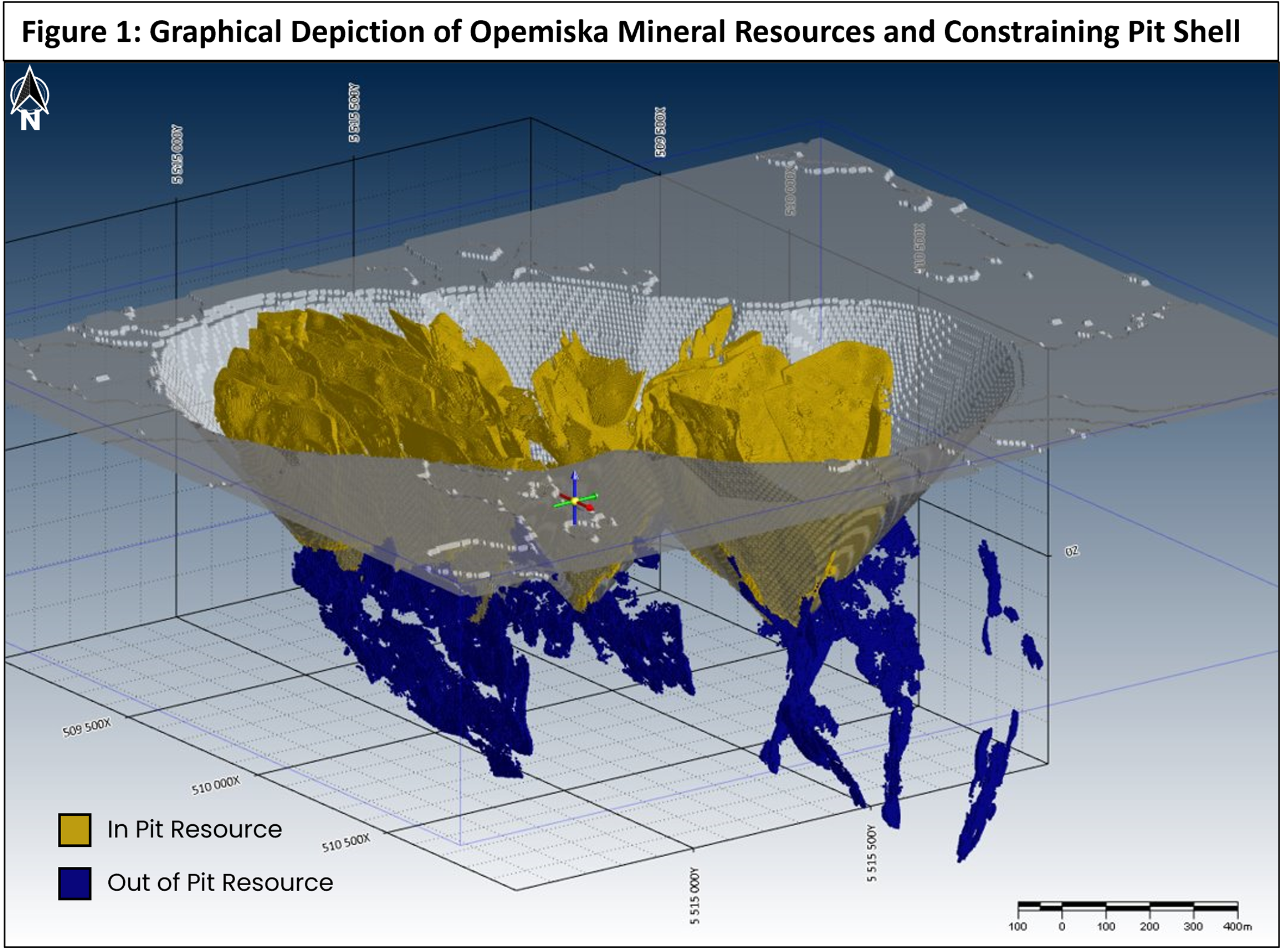

Figure 1: Graphical Depiction of Opemiska Mineral Resource and Constraining Pit Shell

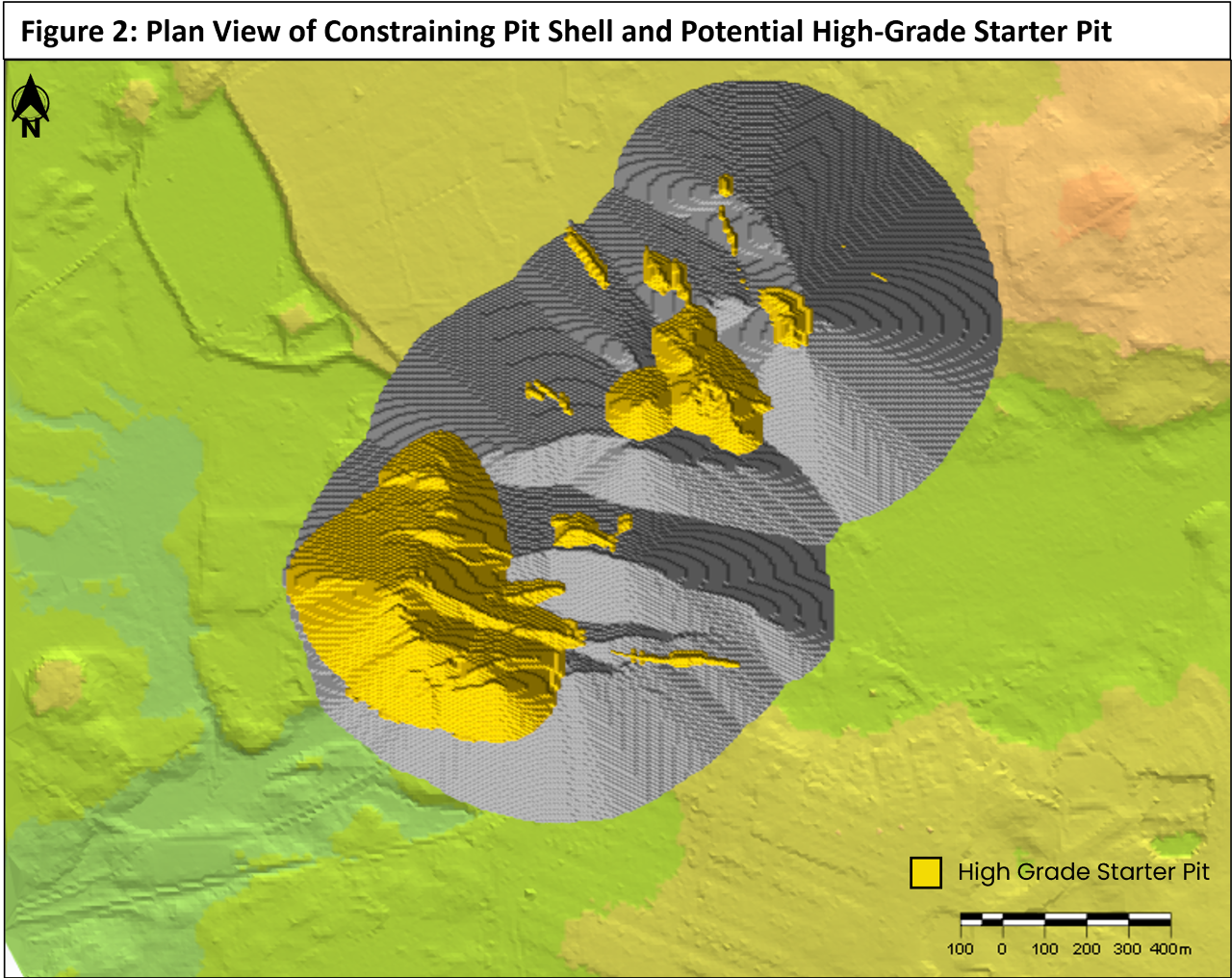

Figure 2: Plan View of Constraining Pit Shell and Potential High-Grade Starter Pit

Starter Pit

A conceptual starter pit has been calculated for the Opemiska Deposit with 19.1 million Measured and Indicated tonnes at 1.1% Cu-Eq. A high-grade potential starter pit provides more options in development scenarios as it allows for a potential short payback period or a staged development scenario, which potentially improves the project's economics.

Table 2: Opemiska Deposit Summary of Starter Pit Constrained Mineral Resource, 0.15% CuEq cut-off

|

Pit Constrained |

Tonnes |

Cu |

Cu |

Ag |

Ag |

Au |

Au |

CuEq |

CuEq |

|

0.15% CuEq Cut-Off |

(k) |

(%) |

(M lbs) |

(g/t) |

(koz) |

(g/t) |

(koz) |

(%) |

(M lbs) |

|

Measured |

11,684 |

0.81 |

207 |

1.96 |

736 |

0.38 |

142 |

1.02 |

264 |

|

Indicated |

7,370 |

0.94 |

153 |

2.40 |

569 |

0.43 |

101 |

1.19 |

193 |

|

M+I |

19,054 |

0.86 |

360 |

2.13 |

1,306 |

0.40 |

243 |

1.09 |

456 |

Out-of-Pit Mineral Resource

A significant out-of-pit Measured and Indicated Mineral Resource has been added to the pit-constrained Opemiska Deposit with 268 million lbs of copper, 83 thousand ounces of gold, and 1.3 million ounces of silver, or 305 million lbs of copper equivalent contained in 10.1 million tonnes. Additionally, there are out-of-pit Inferred Mineral Resources of 23 million lbs of copper, 15 thousand ounces of gold, and 218 thousand ounces of silver, or 29 million lbs of copper equivalent contained in 1.2 million tonnes.

Geological Data and Reinterpretation

The Mineral Resource Estimate on the Opemiska Deposit is based on a drill hole database containing 16,570 surface and underground diamond drill holes totalling 1,042,668 metres of core drilling and 348,492 assays. All mine-era drilling was converted from mine grid to UTM using transformation equations calculated by a land surveyor based on differential GPS measurements of many located drill casings.

All historical mine excavations and stopes were digitized in mine grid coordinates from numerous maps, vertical and longitudinal sections, and solid wireframes were built and converted to UTM coordinates. All stopes were digitized down to the bottom of the Perry (820m depth) and Springer (715 metres) mines and formed the basis of the reinterpretation of the geology of the Opemiska Deposit. Completely new mineralized envelopes were defined using a manually adjusted implicit modelling technique for the deposit based on a structural model defined in 2022 in areas of historical mining and areas of known mineralization that could not be mined underground. As a result, the Deposit tonnage decreased somewhat. However, some out-of-pit Mineral Resources were defined at a 0.8% Cu-eq cut-off that identified a significant tonnage beneath the conceptual pit that will be the object of further drilling along with some satellite zones east of the pit and on the adjacent Cook-Robitaille Option Property.

Next Steps: Further Drilling in-pit and near-pit and Preliminary Economic Analysis

QC Copper has focused all its efforts on finalizing a high-quality mineral resource on the Springer and Perry Mines, to the near exclusion of other objectives. However, the technical team has identified several target areas within the conceptual pit that became apparent during the work that led to the current MRE, but they were not tested due to time constraints. Drilling of these targets is expected to add tonnes and metal to the Mineral Resources beyond what is being published at this time. Moreover, some preliminary drilling on the Eastern Veins in 2022 and early 2023 produced good results, suggesting that modeling these areas will lead to some modest pits at economically viable grades. The Company has proposed 15,000 metres of drilling within the confines of the conceptual pit and near the pit on the Bouchard and McNichols Veins. In addition, the Company has recently completed a drill program (assays pending) on the Cooke-Robitaille area of the Property and will undertake a compilation of historical drill results and integrate the current drilling result to define a drilling program that will hope to define additional open pit Mineral Resources that will add to the Opemiska Project.

About the Opemiska Copper Complex

The Opemiska Copper Complex is adjacent to Chapais, Quebec, within the Chibougamau district. Opemiska is also within the Abitibi Greenstone Belt and within the boundaries of the Province of Quebec's Plan Nord, which promotes and funds infrastructure and development of natural resource projects. The 100%-QC Copper owned Opemiska Property (excluding the the Cooke-Robitaille option claims) covers 24,544 hectares and includes the past-producing Springer, Perry, Robitaille and Cooke Mines, previously owned and operated by Falconbridge between 1953-1991. The project hosts excellent on-site infrastructure, including a power station and direct access to Highway 113 and the Canadian National Railway. The Cooke and Robitaille Mines are situated on the Cooke-Robitaille option claims and QC Copper is working through its obligations regarding the option and has the financial resources and expects to exercise the option in due course. All the other claims that comprise the Greater Opemiska Project are wholly-owned by QC Copper and Gold Inc.

The estimate of Mineral Resources may be materially affected by risks set forth in any QC Copper and Gold’s Management Discussion and Analysis Reports and other filings made with Canadian securities regulatory authorities and available at www.sedarplus.ca.

QP Statement

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, P.Geo and géo., Director and Vice President Exploration for QC Copper & Gold, and Eugene Puritch, P.Eng., FEC, CET of P&E Mining Consultants Inc., both Qualified Persons, as defined in "National Instrument 43-101, Standards of Disclosure for Mineral Projects." Mr. Puritch is independent of QC Copper & Gold.

QAQC Statement

All drilling performed by QC Copper and Gold was done mainly using NQ sized drill rods and were stabilized to minimize deviations. When historical open or backfilled stopes were expected to be intersected in drilling the holes, they were started in NQ and telescoped to BQ after the stope, or started in HQ and reduced to NQ and then BQ, when a second stope was encountered to ensure completion of the drill hole. All drill core is stored in Chapais under constant video surveillance. All pulps and mineralized rejects have been preserved.

For the exploration undertaken by QC Copper & Gold, all assay batches are accompanied by rigorous Quality Assurance procedures, including the insertion of certified reference materials and blanks and duplicate verification assays in a secondary laboratory. Quality Control results, including the laboratory's control samples, are evaluated immediately upon reception of batch results and corrections are implemented immediately if necessary. All drill collars since 2019 were positioned in UTM coordinates and post-drilling surveyed using differential GPS instrumentation. The historical mine drill holes were surveyed on surface and underground at the time of drilling by mine personnel using conventional surveying methods. The drill hole collars for 2019 were oriented by compass but since 2021 accurate non-magnetic orientation of collars was achieved using the gyroscopic Azimuth Aligner by Minnovare. Downhole deviation surveys were done initially with Flex-it instrument by Reflex instrument at 30m intervals and from 2021 with the Champ Gyro instrument manufactured by Axis Mining Technology. All erroneous azimuths caused by excessive magnetism or other causes were purged from the database. A systematic bulk density measurement program using the water displacement method was implemented to measure the bulk density of all rock types. A total of 1,178 bulk density measurements were done since the start of drilling in 2019 drilling program, including 1,028 measurements for the Initial Mineral Resource Estimate (“IMRE”) in 2021 and an additional 150 measurements post IMRE. No bulk densities are available for the vendor drill holes or historical mine drill holes. A specific susceptibility measurement protocol was also implemented to estimate the relative abundance of magnetite in the Ventures Sill's variably magnetic rocks. A focused optical and acoustic televiewer surveying program was done at the end of the program to obtain correctly oriented structural measurements.

For the Mineral Resource database, additional QAQC measures included drill core duplicates. For the historical drilling assay verification, measures comprised drill core resampling for the holes drilled by the vendor in 2010, 2015 and 2016 and for the historical Falconbridge mine era drilling where no drill core remains, a number of holes were collared near the location and orientation of mine-era surface drill holes and results compared with the assays from the mine. The results of these measurements confirm that the assays from the vendor period are equivalent to QC Copper assays and that the mine era assays are demonstrably equivalent for the range of values from the lower detection limit up to approximately 2.0% Cu which represents over 90% of the assays in the Mineral Resource database. Above this grade, the number of samples in the twinned data is small, and the variance is high, making it challenging to compare datasets.

It is challenging to obtain good validation of historical assays using the twin-hole drilling method for the mine drill holes that were not sampled extensively and were sampled only where mineralization was visible. Further validation of historical mine assays will require high-density drilling in small zones that have not been mined, however, were drilled sufficiently by Falconbridge to allow comparison of assay tenor, independent from the mine assays and from QC Copper drilling in the same volume. The evidence from twin drilling, albeit imperfect, supports the interpretation that the assays for the bulk of the mine drilling are comparable to modern-day QAQC-controlled assays. After reviewing available data, the assays undertaken by QC Copper, the vendor, and the mine are considered acceptable for estimating a Mineral Resource on the Opemiska Project.

For information and updates on QC Copper and Gold, please visit: www.qccopper.com

And please follow us on Twitter @qccoppergold

To speak to the Company directly, please contact:

Stephen Stewart, Chief Executive Officer

Phone: 416.644.1567

Email sstewart@oregroup.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the TSX Venture Exchange policies) accept responsibility for this release's adequacy or accuracy. Certain information in this press release may contain forward-looking statements. This information is based on current expectations subject to significant risks and uncertainties that are difficult to predict. Actual results might differ materially from results suggested in any forward-looking statements. QC Copper and Gold Inc. assume no obligation to update the forward-looking statements or to update the reasons why actual results could differ from those reflected in the forward looking-statements unless and until required by securities laws applicable to QC Copper and Gold Inc. Additional information identifying risks and uncertainties is contained in QC Copper and Gold Inc. filings with Canadian securities regulators, which filings are available under QC Copper and Gold Inc. profile at www.sedarplus.ca